Finance and Technology

8 Jan 2022 · 976 words · 5 minute read

Finance and Technology

The terms, finance and technology are are analogous in our daily lives. While finance has existed since ancient times (by way of barter trade or using specific currencies to trade for necessities), technology pickup has been a more recent event, comparatively.

The challenge or complication comes when both of the two broad fields are married together to become “Fintech”. The term has been loosely used these days wherein anything that has to do with them together would be considered Fintech.

So what exactly is Fintech? I would think, Fintech, is the application of technology coupled with the ingenious human capital to deliver value-added solutions to the financial services sector, as a whole.

Fintech Considerations

While there are multiple ways to slice and dice Fintech categories or types, by-and-large, one of the better ways of classification (in my point of view) is insurance, trading, risk management, and banking as defined via Wikipedia here.

While traditional finance has been long dominated by banks, this ‘neo-finance’ field opens up a whole world of possibilities while potentially, making the world a better place. Several key areas that saw value-added improvements, among others, are:

- Lower barrier of entry to various audiences

- Transaction speed improvement

- Simplicity in the whole transaction management lifecycle

- Ease of record retention

- New potential business frontiers in the world of trading bots or algo-trading

- New frontier in data analytics

- Lesser middle man in financial transactions

- More efficient financial market

With pros, there would be cons as well to have a balanced view. Henceforth, several considerations are:

- Potential larger tailed events in the financial market given the possibilities of algo-trading gone wrong

- More avenues on potential ethical/regulatory wrong doings by market participants (e.g. LIBOR scandal)

- Increased transaction activities (due to electronic trading) may not value-add to investors, especially with the presence of middle-person (in fact, may benefit middle-person instead)

- More opportunities (unfortunately) for criminals to engage in potential money laundering or terrorism financing

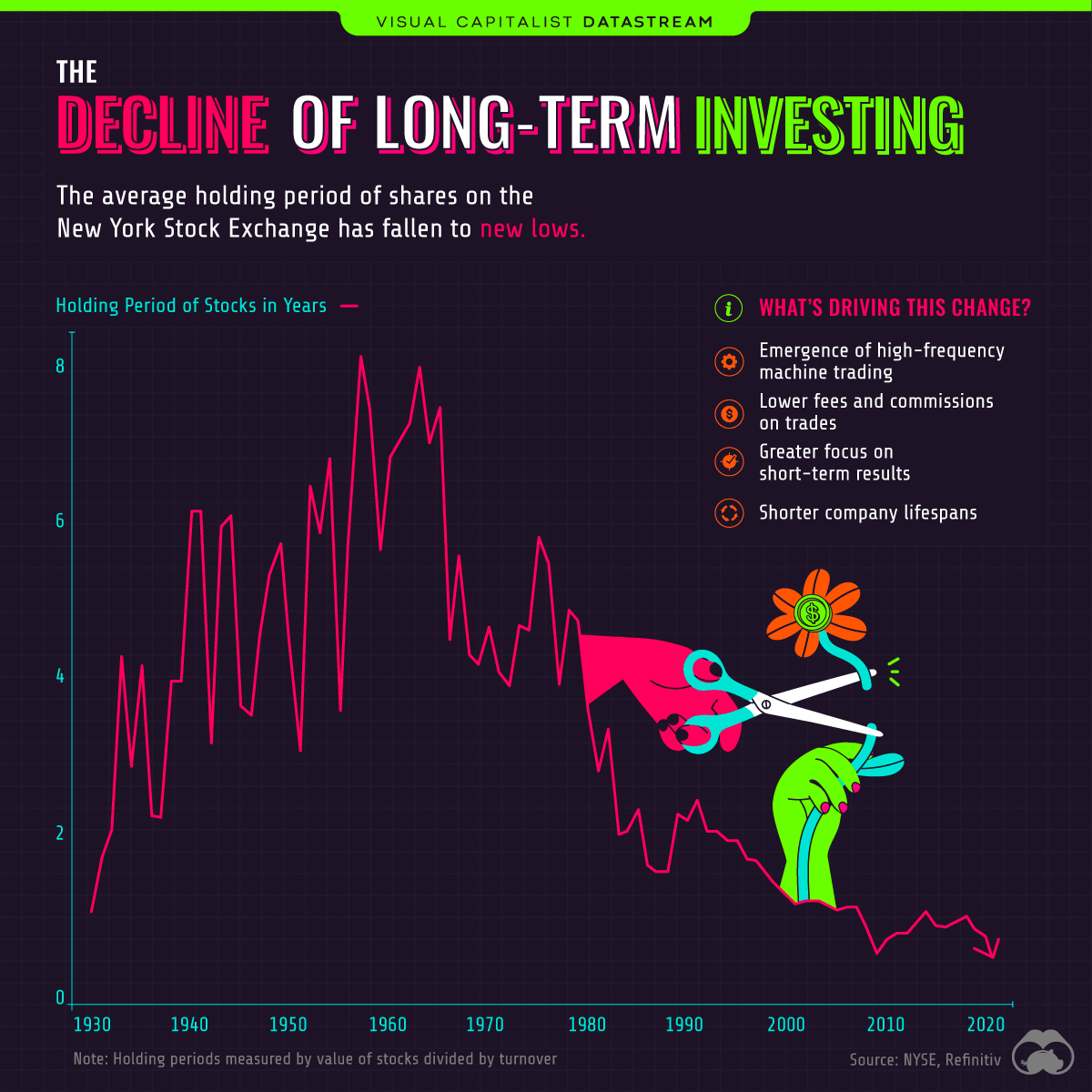

- Shortening of investment holding period (may or may not be bad; to be elaborated further later)

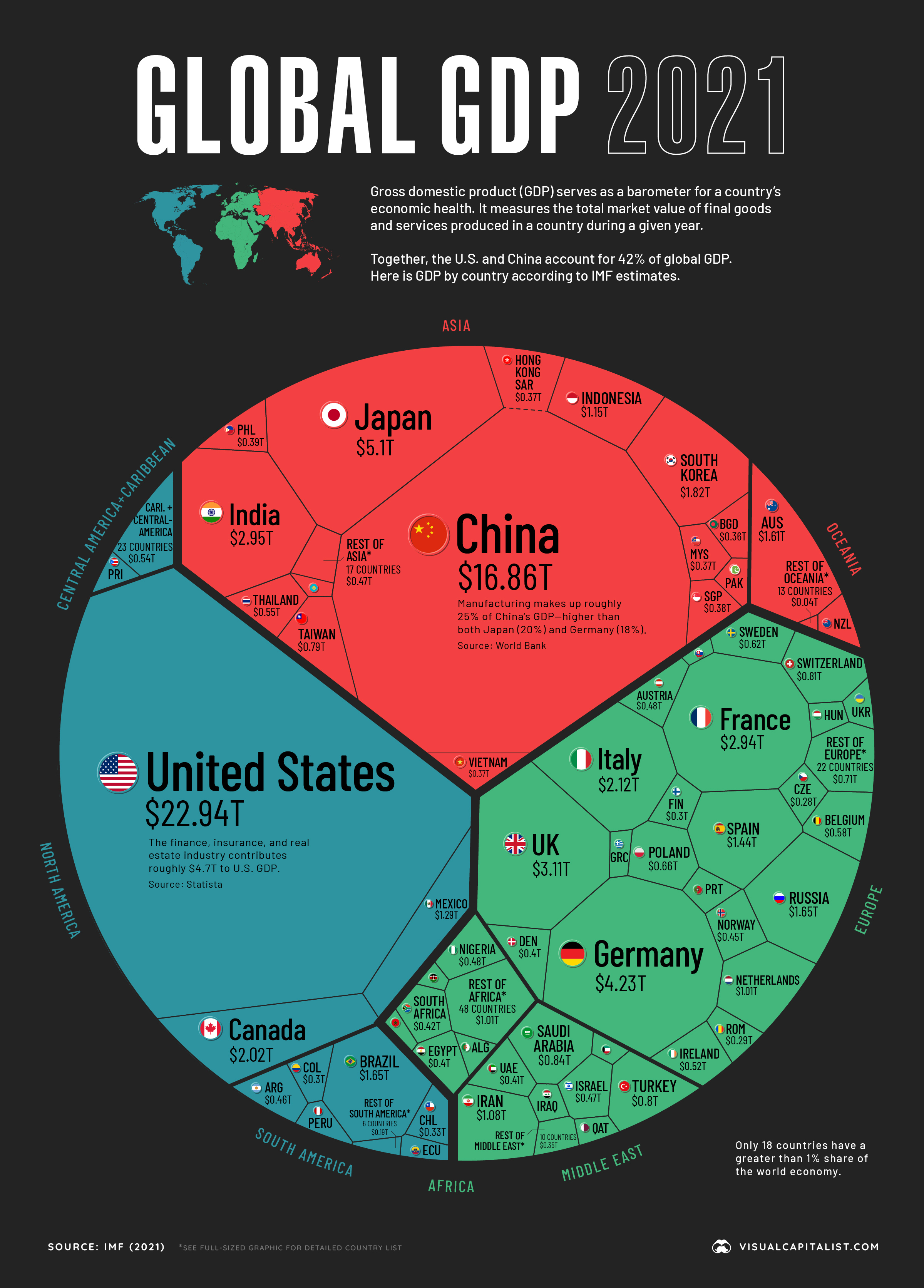

While there are disadvantages, one cannot deny the positive changes brought forth by the tech sector. Tech output generally results to increased total productivity factor and drive the increase in GDP growth rate.

source: Visual Capitalist

Feel free to dive further on other Fintech applications via this Investopedia URL.

Blockchain and Cryptocurrency

With the blockchain and cryptocurrency still hot in discussion, thought would be worth while to touch on this topic a bit.

While I would not be elaborating too much on this aspect, there is a good read up that discusses more in-depth regarding tihs topic and can be found here.

Technology-as-an-Enabler

While some may view technology as the new way of doing things, I think stand by the thought that technology enables us to achieve what we need in a better fashion. In addition, it also opens up other fields related to existing sectors, to go up the value chain. Technology-as-an-enabler emerged at the forefront of this area. Among others, technology has enabled us to (Fintech-centric):

- Bridge the gap for stock investments to individuals

- Cheapen remittance to individuals

- Increase the velocity of credit facility adoption and application by folds to individuals and SMEs alike

- Potential talks on blockchain’s use to make sure there is not misrepresentation to lenders on repeated use of collateral in the trade finance industry

There are endless possibilities (be it improvement or new fields) that would be enabled by technology, especially in the field of finance that predates ancient times.

Implications of Fintech

While technology has shook the foundations of many sectors (especially finance field), there are interesting implications observed. As its role to ‘enable’ and open up doors of possibilities, it direct impacts human behaviours.

One of the observed changes is investor’s holding period for stocks have declined over the years. Many may argue that there are other key factors to observe (e.g. faster global pace, globalised environment vs previous, and others), but technology is definitely a contributing factor given now, via a click or tap (vs a phone call to brokers), investors can deploy capital or redeem stocks easily. As there are many stock brokers in the US offering free trading, this would increase the ‘short-termism’ within investors.

source: Visual Capitalist

While previously investors may act based on their own call from sources such as rumours, research reports, and own analytics, emergence of electronic trading assists to put the investment decisions to be automated by rational bots or algorithm that operates via rules. As humans, it is very difficult to avoid the behavioural biases, be it cognitive or emotional ones, that are innate within us. For example, we may act on current situation based on past experience (representativeness bias) or just think that we are very good in what we are doing (overconfidence). Having an eletronic trading platform with inbuilt algorithm or bots, eliminate the potential biasness that we are saddled with and enables better decision-making process (provided they have to be checked at all times).

Another implication is, there would be more pronounced tail events happening, going forward. Events such as algos going haywire or outsized ‘wins’ in the crypto market or even another GameStop saga, would happen more often as well. This is due to increased access into the financial system, coupled by deeper penetration offered given the improved tech stack.

Conclusion

While there a lot of pros, cons, and potential implications, technology growth is here to stay and it is the main driving force of a country’s GDP (especially in developed countries).

Though I may chide some of those folks who overuse the Fintech term in everything (drawing parallel to those folks who overused the term pivot), I am a firm believer that the world would progress to a better place with technology being the fore-front, creating more possibilities to us, especially in the financial sector.